Honduras (Last reviewed 03 February 2023) Guernsey, Channel Islands (Last reviewed 04 January 2023) Gibraltar (Last reviewed 04 December 2022) Under the flat rate scheme this is the CHRL: 1 Under the standard rate scheme these are NHIL: 2.5, GETFL: 2.5 and CHRL:1. Some items are also zero-rated for VAT purposes.ġ9 (A temporary deduction of the VAT rate on meals provided in restaurants and through other catering services from 19% to 7% remains in force until 31 December 2022 in response to the COVID-19 pandemic.)Īdditional levies are charged on taxable supplies. Municipal Service Tax (ISS): 2% to 5% (cumulative).Ĭabo Verde (Last reviewed 05 February 2023)Ĭambodia (Last reviewed 15 February 2023)Ĭameroon, Republic of (Last reviewed 31 March 2023)Ĭombined federal and provincial/territorial sales taxes range from 5% to 15%.Ĭayman Islands (Last reviewed 06 February 2023)Ĭhina, People's Republic of (Last reviewed 30 December 2022)ġ3, 9, or 6 depending on the types of goods and servicesĬongo, Democratic Republic of the (Last reviewed 31 December 2022)Ĭongo, Republic of (Last reviewed 24 February 2023)Ĭosta Rica (Last reviewed 12 January 2023)Ĭzech Republic (Last reviewed 01 February 2023)ĭominican Republic (Last reviewed 12 January 2023)Įl Salvador (Last reviewed 16 January 2023)Įquatorial Guinea (Last reviewed 24 March 2023)Įthiopia (Last reviewed 07 December 2022)ĩ% or 15%, depending on the goods or services being supplied. State VAT (ICMS): Normally between 17% and 20% (lower rates apply to inter-state transactions, varying between 4%, 7%, and 12%)

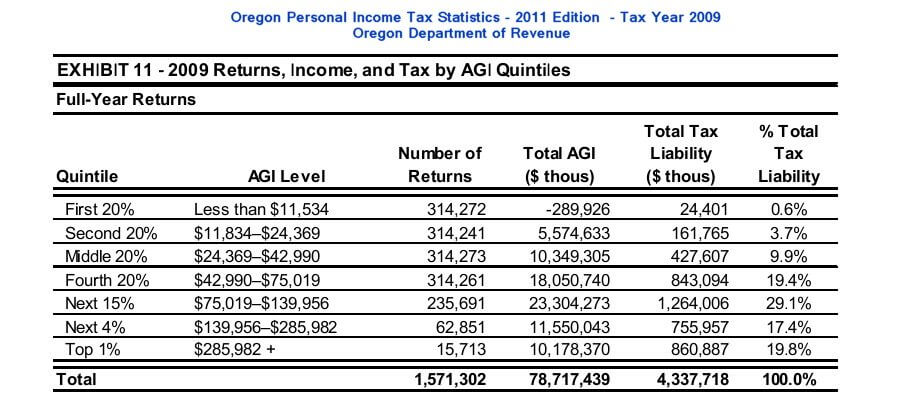

Oregon State Personal Income Tax Rates and Thresholds in 2023 $ 0.00 - $ 6,500.Argentina (Last reviewed 22 February 2023)Īustralia (Last reviewed 09 December 2022)Īzerbaijan (Last reviewed 23 February 2023)īarbados (Last reviewed 14 February 2023)īosnia and Herzegovina (Last reviewed 21 April 2023)Įxcise federal tax (IPI): Normally between 5% and 30% įederal VATs (PIS/COFINS): Generally a combined rate of 3.65% (cumulative) or 9.25% (non-cumulative) Oregon State Married Filing Jointly Filer Tax Rates, Thresholds and Settings Oregon State Single Filer Personal Income Tax Rates and Thresholds in 2023 Standard Deduction Oregon State Personal Income Tax Rates and Thresholds in 2023 $ 0.00 - $ 3,300.00

Oregon State Single Filer Tax Rates, Thresholds and Settings Oregon State Single Filer Personal Income Tax Rates and Thresholds in 2023 Standard Deduction If you would like additional elements added to our tools, please contact us. The Oregon tax tables here contain the various elements that are used in the Oregon Tax Calculators, Oregon Salary Calculators and Oregon Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers.

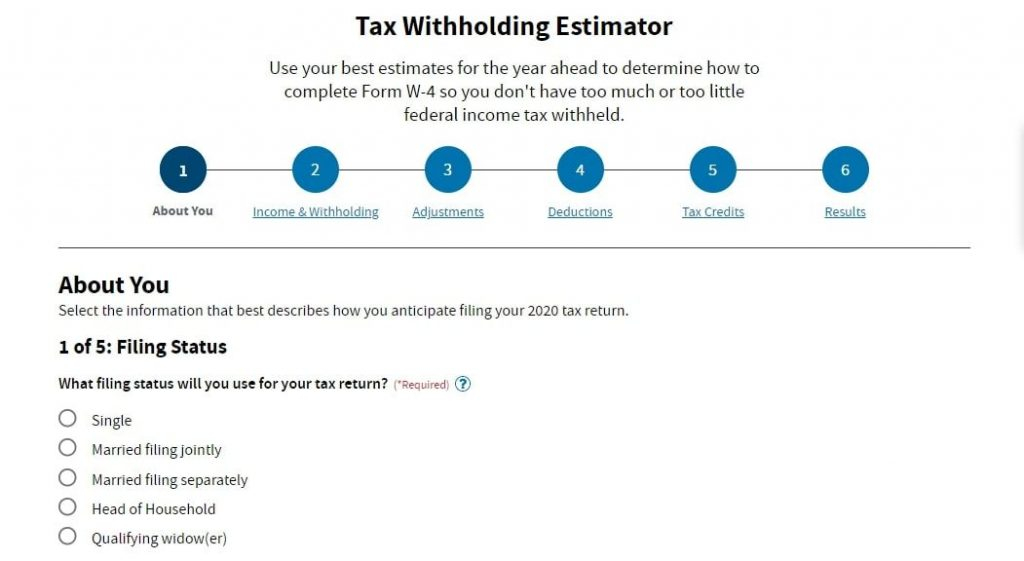

OREGON STATE INCOME TAX BRACKETS 2020 FULL

The Oregon State Tax Tables below are a snapshot of the tax rates and thresholds in Oregon, they are not an exhaustive list of all tax laws, rates and legislation, for the full list of tax rates, laws and allowances please see the Oregon Department of Revenue website. This page contains references to specific Oregon tax tables, allowances and thresholds with links to supporting Oregon tax calculators and Oregon Salary calculator tools. Tax rates and thresholds are typically reviewed and published annually in the year proceeding the new tax year.

The Oregon Department of Revenue is responsible for publishing the latest Oregon State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Oregon. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The Oregon State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Oregon State Tax Calculator.

0 kommentar(er)

0 kommentar(er)